Snowflake’s Signs of Slowing Down

Snowflake is a company known for its hypergrowth and nose-bleeding valuation. None of that changed after the earnings result last week, but signs of slowing down are emerging.

The company grew its product revenue by 103% YoY last quarter, slightly lower than the 110%+ level in the past few quarters but still growing at triple digits, and the 169% net retention rate was strong as ever. The premium valuation also remained unchanged even after the stock lagged the market in 2021, currently trading at 57x NTM revenue.

Close

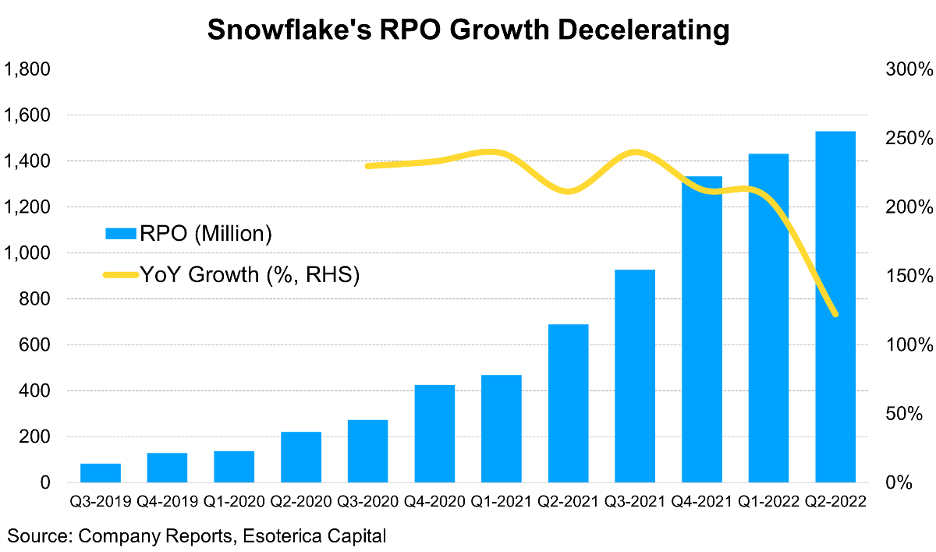

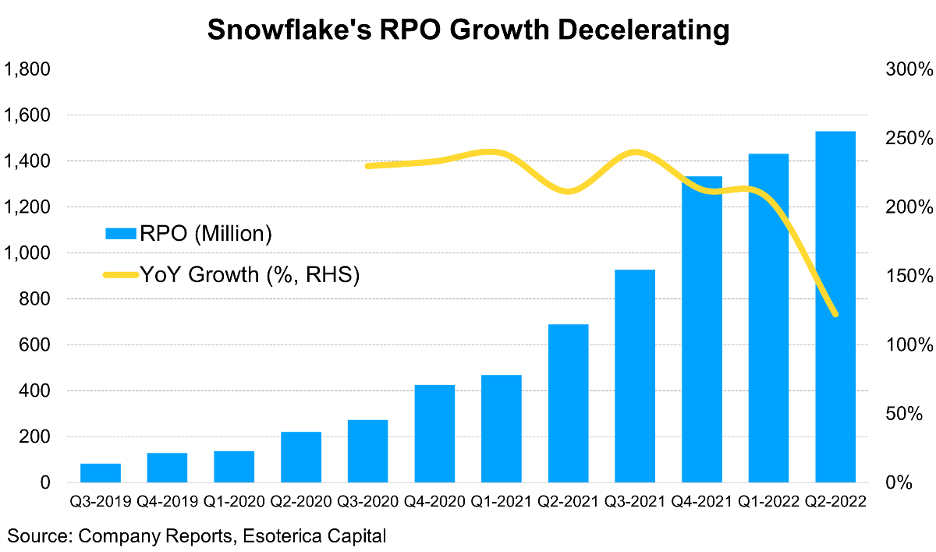

However, signs of slowing down are emerging. The revenue beat of less than 6% in the second quarter is the smallest since the company's IPO 12 months ago. More importantly, the remaining performance obligation (RPO), a key measure for software company's backlog, decelerated significantly to ~120% in the second quarter from 200%+ in the prior quarters. On the conference call, management pointed to a multi-year $100M deal in the year-ago quarter, creating a tough comparison. However, on a sequential basis, RPO growth of less than 7% in the second quarter is well below prior levels. The market seems to have shrugged off the slower RPO growth for now, but this is likely something worth keeping an eye on going forward.

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.