How to Measure Economic Cycles

People often describe markets in terms of being in an “up-cycle” or “down-cycle,” without justifying that conclusion.

I like to use leading economic indicators – LEIs – to objectively determine our location in an economic cycle, with a precise quantitative metric.

“Leading economic indicators are those that change before economies show any signs of change.” LEIs are a single number, broadly based on four inputs:

Labor Market: The amount of slack in labor.

Consumption: The robustness of the local consumer spending activities.

Production: The amount of slack in manufacturing.

Market Prices: The stock market is believed to be a forward-looking market. In addition to stock market performance, the market level of interest rates and the shape of the interest rate curve are used in LEI calculations.

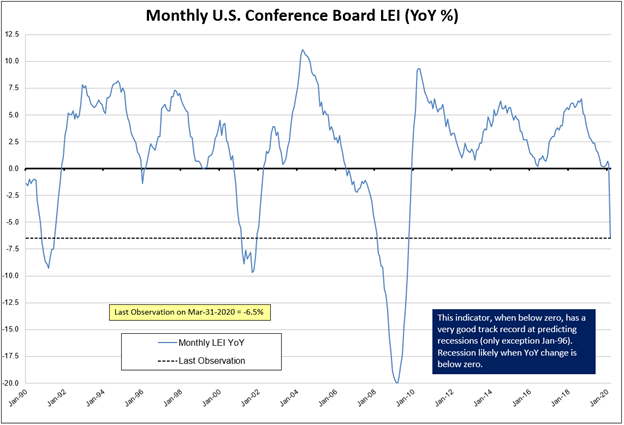

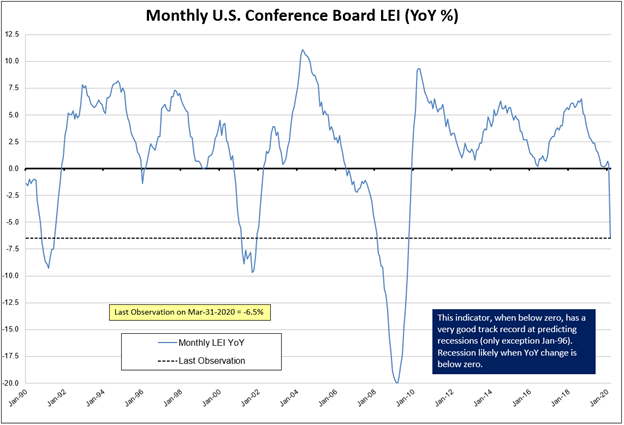

I think LEIs are good way to track the global cycle. Below is a chart of one of the U.S. LEIs (Each country tends to have multiple leading indicators.) As you can see, the year-over-year metric makes it easy to separate expansion cycles from deceleration cycles (upward sloping vs. downward sloping).

Close

Moreover, you can go one additional step and segment episodes of deceleration from contraction, by when the indicator falls below zero. Notice the so-called energy recession in 2015; it was a slowdown/deceleration, but not a contraction. The COVID-19 slowdown in 2020, on the other hand, was a contraction.

Yearly changes in LEIs, like those shown, tend to be very slow-moving indicators. They are cyclical indicators, not tactical indicators. I like to think of a major economy, like the U.S., as a tanker ship. It takes a long time, months, for the tanker to change direction (it’s a tanker, not a jet-ski), but when it does change course, it tends to continue in that new direction for multiple years at a time.

Knowing whether you are in an economic “up-cycle” or “down-cycle” can be used to adjust your investment risk profile. It is prudent, but not a guaranteed formula for success, to move “up higher on the capitalization structure” during down cycles. What does that mean? During down cycles:

Developed market equities tend to outperform emerging markets;

Firms with higher quality balance sheets tend to outperform;

You want to be long the liquidity risk premium, not short;

You want to build natural hedges (e.g., being long fixed income duration and convexity); etc., etc., etc.

In short, it is prudent to reduce your portfolio risk profile during “down” markets.

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.