Asset Allocation for Diversification

Asset allocation is a technical term to describe an investor’s allocation or distribution of investment dollars.

Textbooks say your asset allocation process should revolve around a concept known as diversification, which simply means you should not “put all of your eggs in one basket.”

Building wealth should be more sophisticated than betting your entire future on one, or even a handful, of stocks. It does not matter how optimistic you are about a particular company (or small collection of companies), you can never be sure. Your economic future is too important not to be more pragmatic.

What else do you need to know about prudent portfolio construction? I like to think of an investment portfolio as containing two main components: your core holdings and your satellite holdings. I like to use a food analogy to better describe core versus satellite allocations. Core holdings are akin to the entrée – the “meat-and-potatoes” of your meal. Satellite holdings, in contrast, complete your meal…they can be thought of as your side dishes and/or desserts. The largest portion of your portfolio, like your meals, should be core.

Your core holdings should include broad based exposure to multiple asset classes, such as stocks, bonds, commodities, etc. Each asset class will be well diversified. For example, your core equity exposure may be the S&P 500, a collection of 500 different stocks, scattered across 11 major sectors and/or industries.

Your satellite holdings are particular segments of the market that you want to over emphasize. As an example, you may want to include small capitalization stocks (e.g., the S&P 600) to augment your core large cap equity exposure (e.g., the S&P 500). Alternatively, your satellites might include allocation tilts to different Tech categories, to emphasize (and hopefully exploit) the growing global digitization trend.

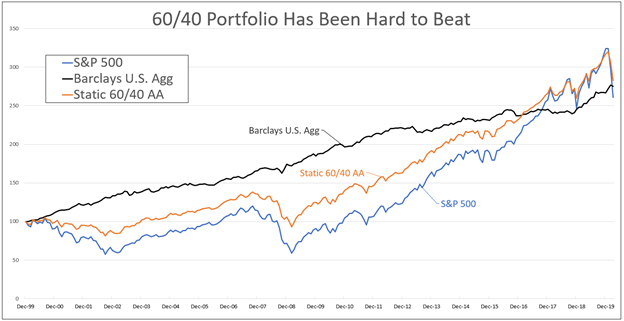

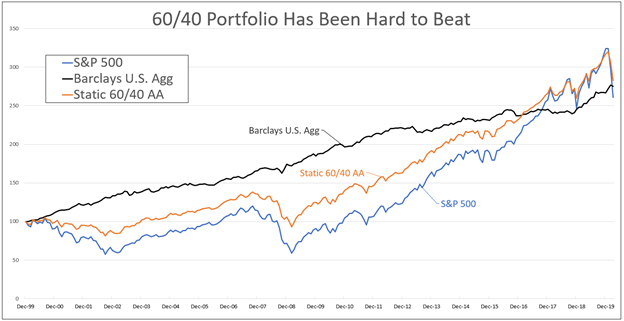

The chart below highlights the importance of diversification in your core holdings. The chart compares three different investment strategies, with $100 invested in each strategy on December 31st, 1999 and held until March 30th, 2020.

Close

The black line in the chart demonstrates the results if your entire core portfolio consisted of only U.S. bonds (the capitalization weighted U.S. bond market). The blue line represents the performance of 100% allocation to the S&P 500. The tan line denotes a combined stock-bond portfolio, consisting of 60% S&P 500 and 40% U.S. bonds.

Notice that throughout most of this 20-or-so-year study, the combined 60/40 portfolio outperformed the all-equity portfolio. This finding is even more impressive when one considers that 2009-2019 represented the longest period of uninterrupted economic expansion in history (i.e., the longest bull market)!

But wait, there’s more. The 60/40 portfolio not only outperformed the all stock portfolio, it did so while subjecting the investor to 40% less risk. Build wealth while jointly preserving it.

The intuitive reason, why the 60/40 portfolio is hard to beat, is stocks tend to outperform bonds during “up” market cycles, whereas bonds are more defensive and tend to win during “down” cycles.

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.