SaaS Market and Valuation Update

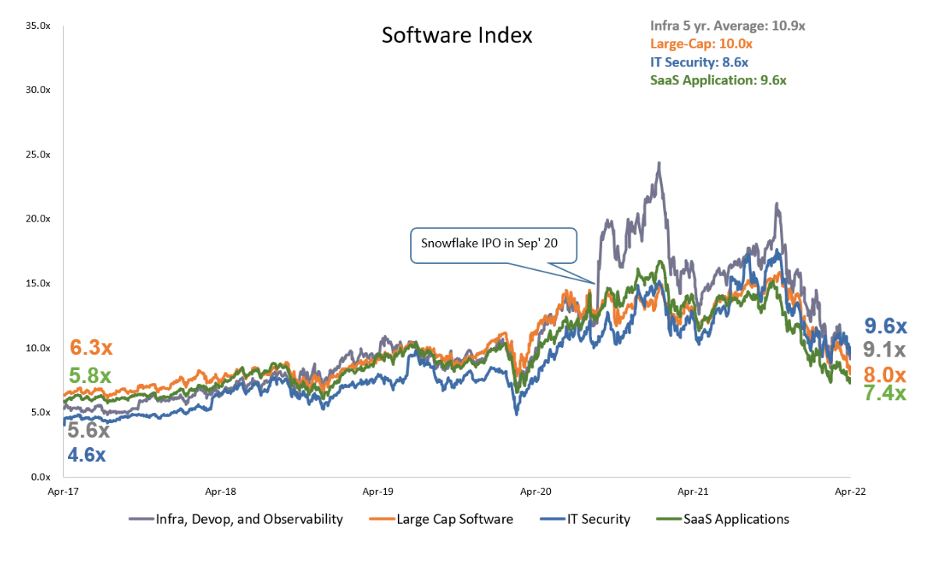

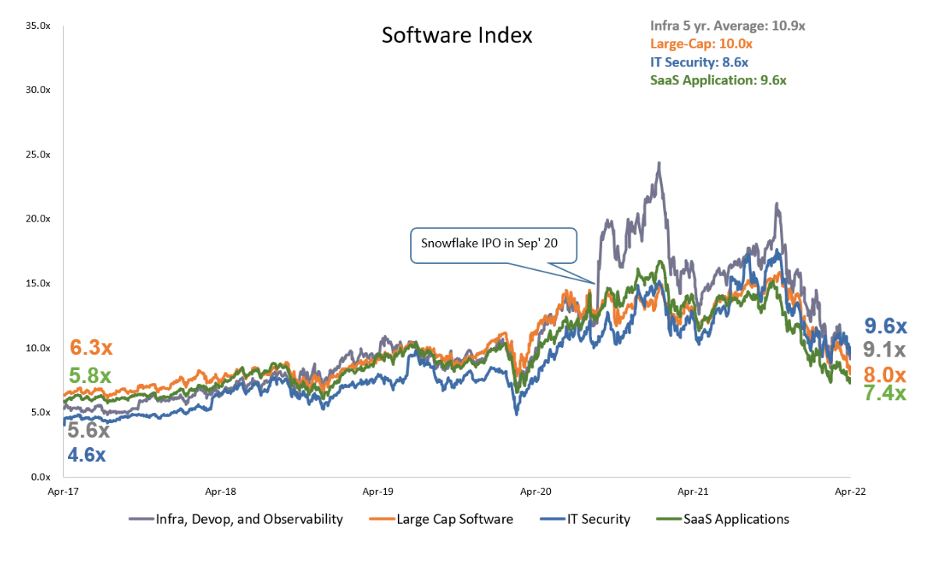

Valuation: Another week of market-wise sell-off amid inflation fear. Within SaaS, Security's valuation moderated down from 10.0x. Large-cap trading at 8.0x following a week of heavy earnings. Infrastructure dropped from 9.6x to 9.1x. SaaS applications continued to lag at 7.4x.

MSFT: No Macro Risk in Sight

As the first FANG company to report, Microsoft set the tone for the software spending dynamics. Though most investors would agree that MSFT has the best set-up among FANG, fears of a slow down in macro and Office 365 hovered over investors' minds. However, numbers spoke louder than words. MSFT once again delivered a strong result highlighted by continued strength in Azure and consistent growth in Office 365, both in terms of seats or $ revenue. The management did not seem bothered by macro conditions and its exposure to the EU, Russia, and Ukraine. In addition to Azure, the strongest business moat comes from the breadth of product offerings and its channel distribution. Consistency, growth, and potential upside for Q4 unpins its attractive valuation.

ServiceNow: Short and Sweet, Better Than Feared

NOW kicked off the new fiscal year with a clean result, beating across all metrics. cRPO grew 30.5% cc vs. 30% expected. Subscription revenue up 29% and about 1pt ahead of expectations. Management highlighted the strength in the pipeline and expected net new ACV acceleration to not only manifest in Q1 but to continue throughout the year. It's worth mentioning the sales motion at Now as we see the company has increasingly evolved into a platform. The company is able to bridge the gap across many different departments and sell its solutions. This is driven by 1) IT service has become a business strategy, and customers are open to buying big bundles. More than 1,400 customers have 1M+ ACVs; 2) strong value proposition to manage myriads of applications using one platform and one architecture.

Close

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.