Amazon: Looking Under the Hood

Amazon stock fell more than 7% the day after its second-quarter earnings report last week, making it the worst day since the beginning of the pandemic. The decline was due to a rare miss of revenue. The last time Amazon missed revenue forecast was almost three years ago. We understand the negative reaction but don't think the result is as bad as it seems.

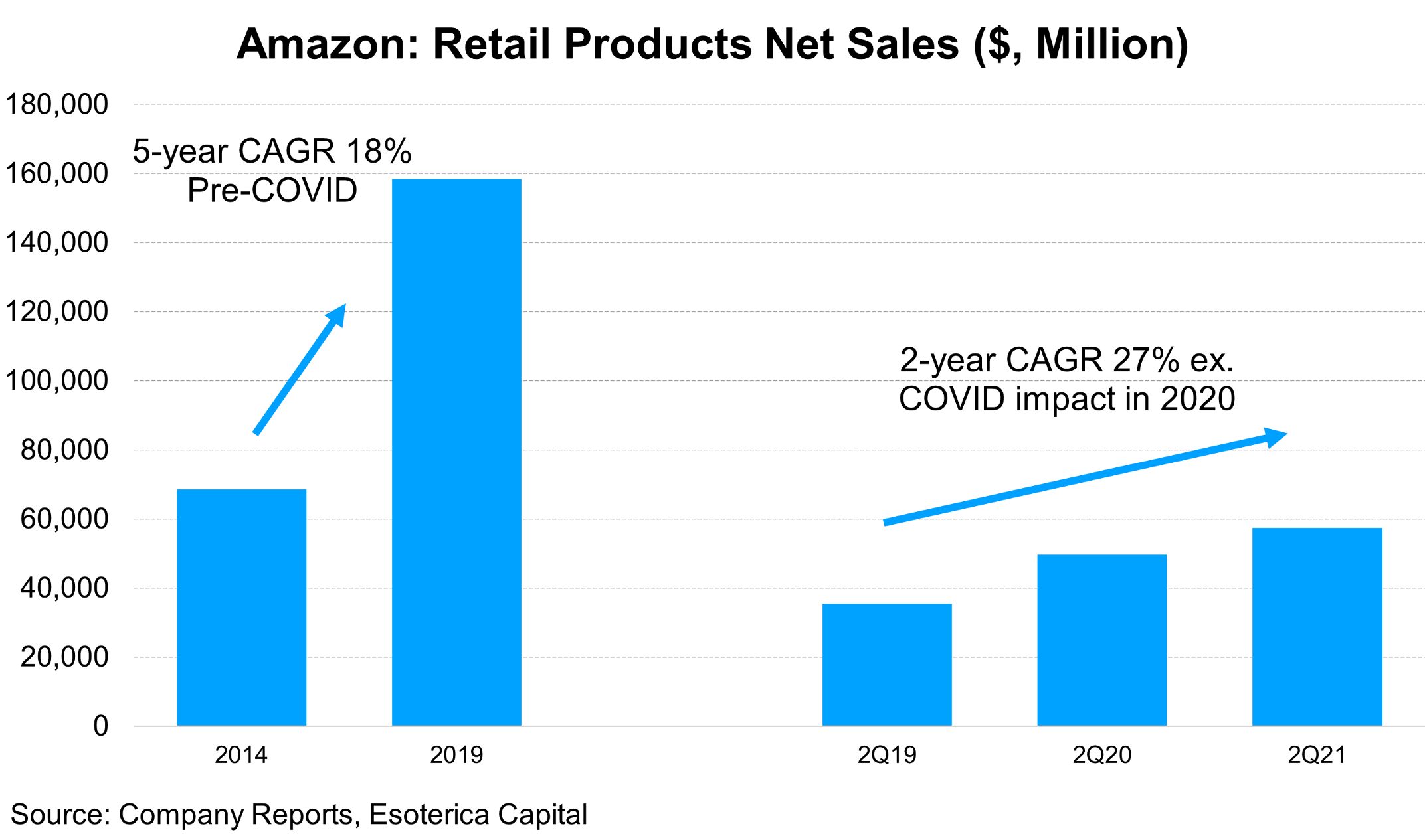

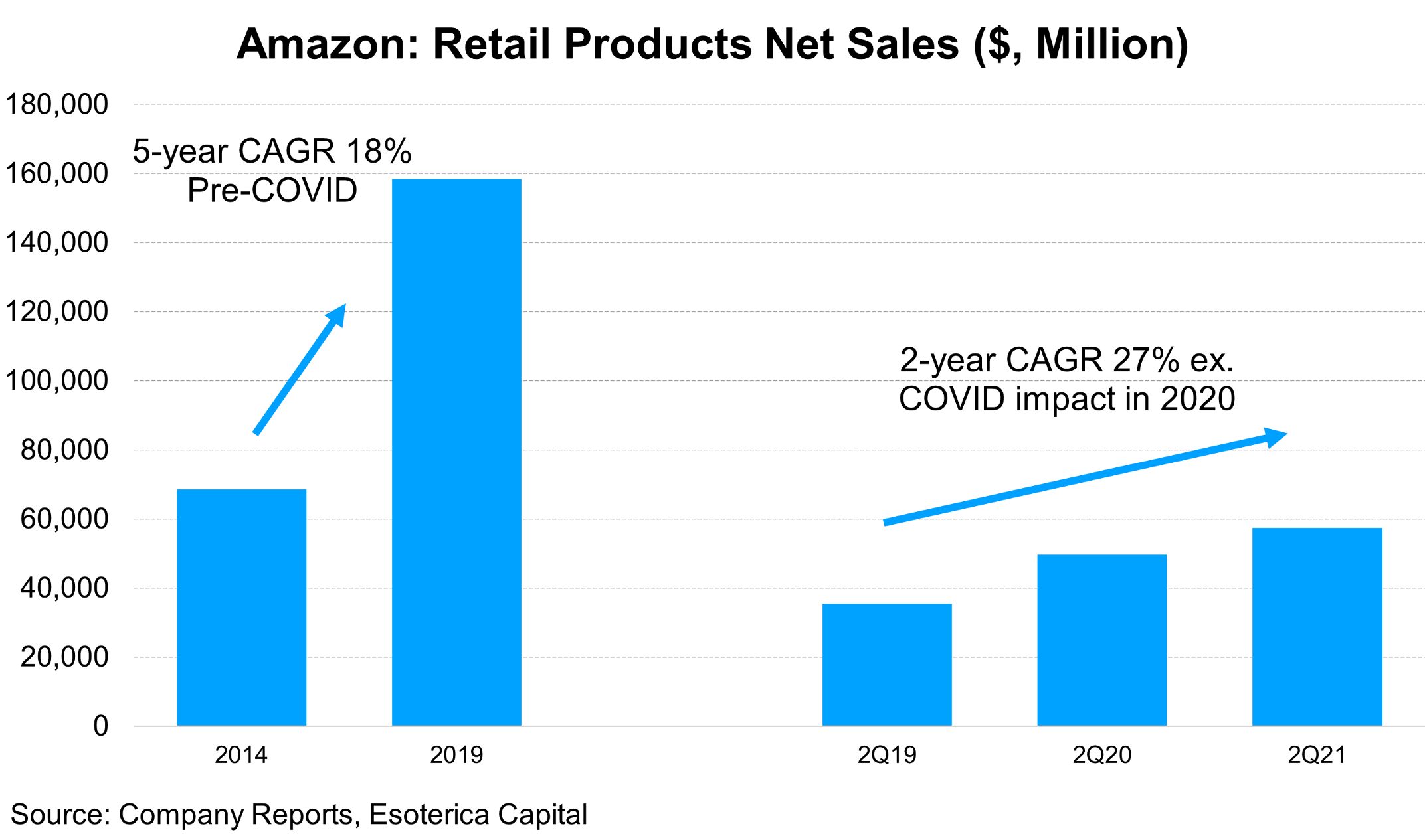

The revenue miss was driven by the soft retail business, which benefited significantly in 2020 due to COVID and created tough comparison. If we look at the comparison vs. 2019, the 2-year CAGR of 27% is comfortably ahead of the growth rate pre-COVID.

Close

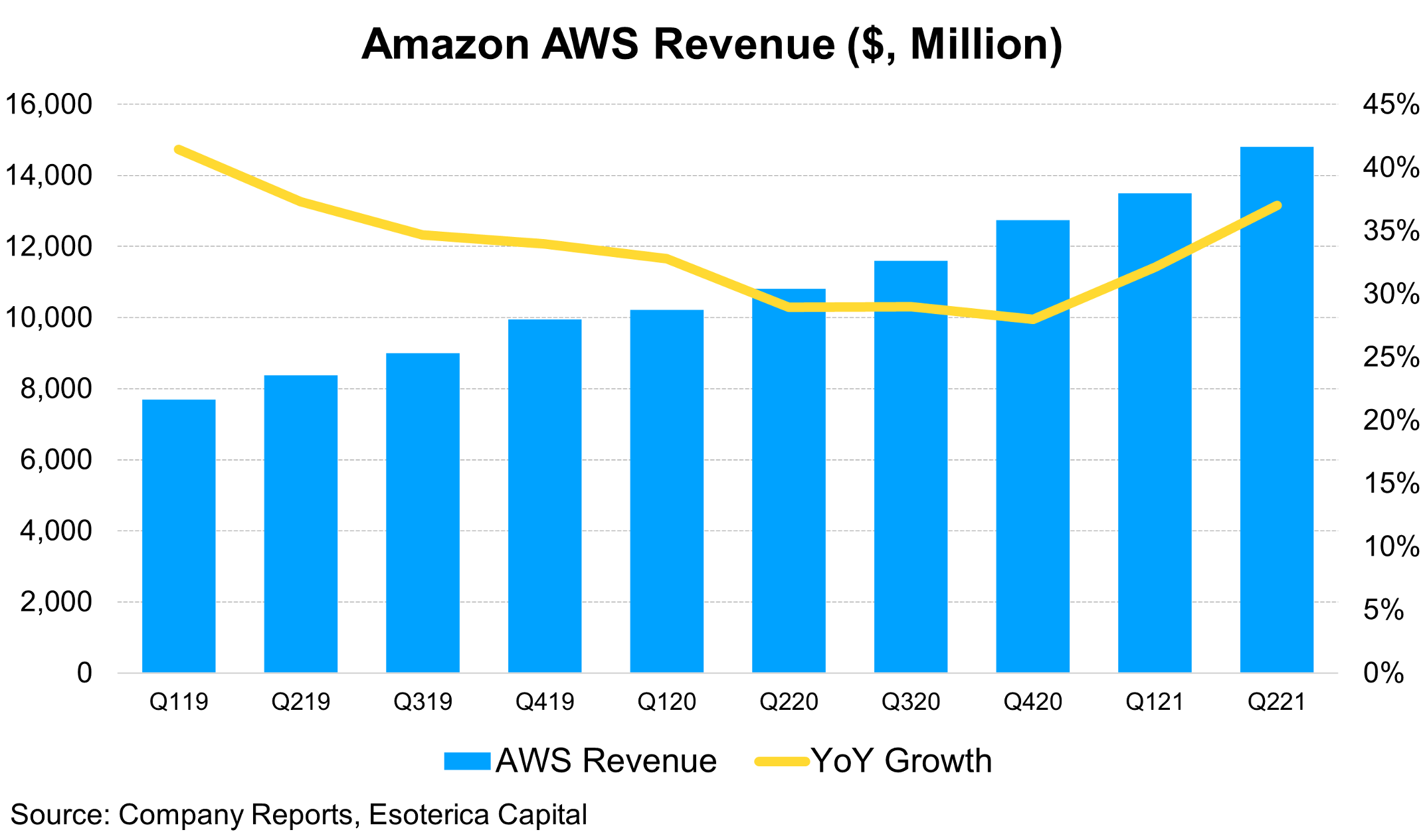

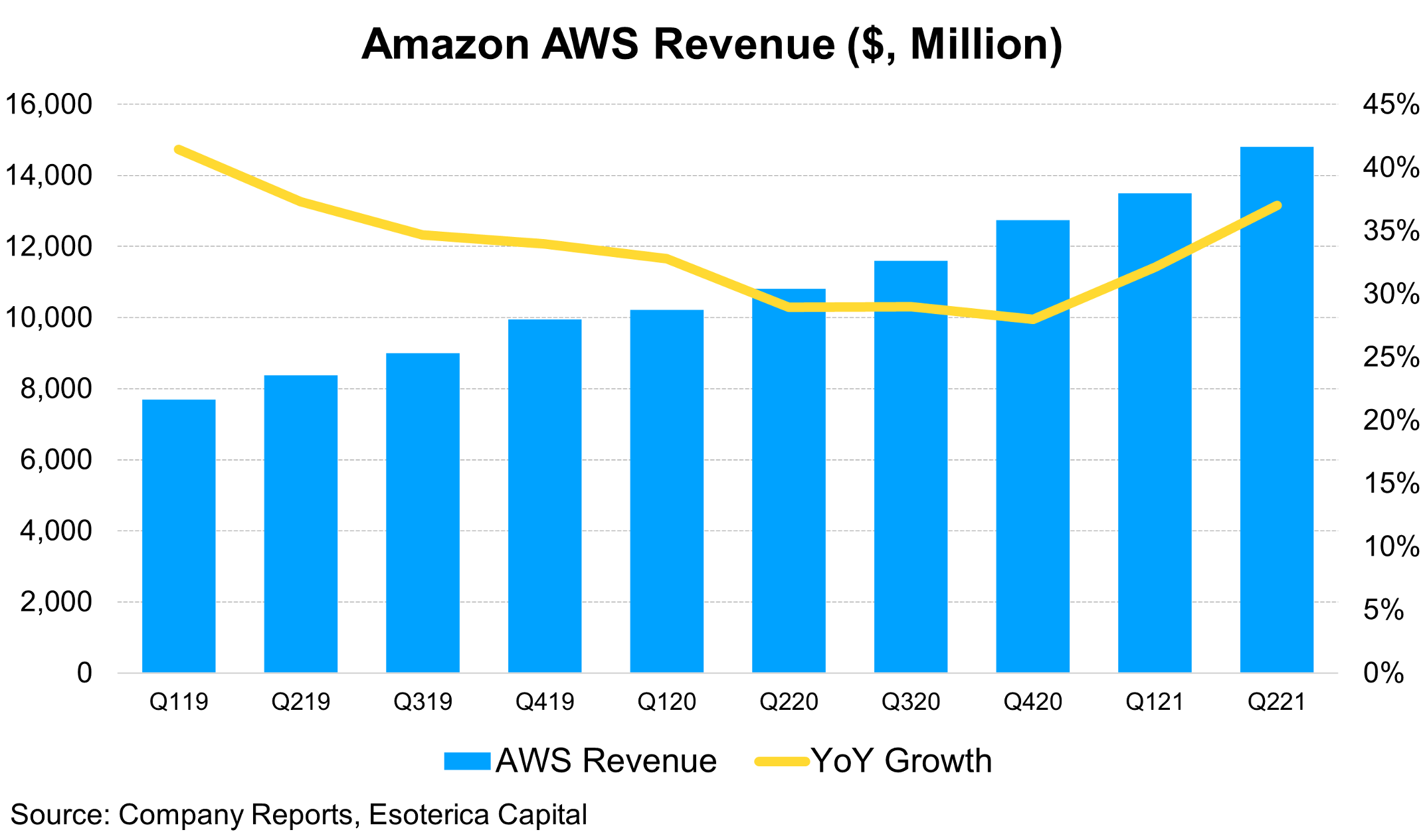

More importantly, the high margin part of the business keeps accelerating in the second quarter, especially AWS and advertising. AWS grew 37%, a significant acceleration compared to 28% growth in FQ4'20 and 32% last quarter. It is now a $60 billion business with ~30% operating margin growing at more than 30%, a rare combination you don't see very often.

Close

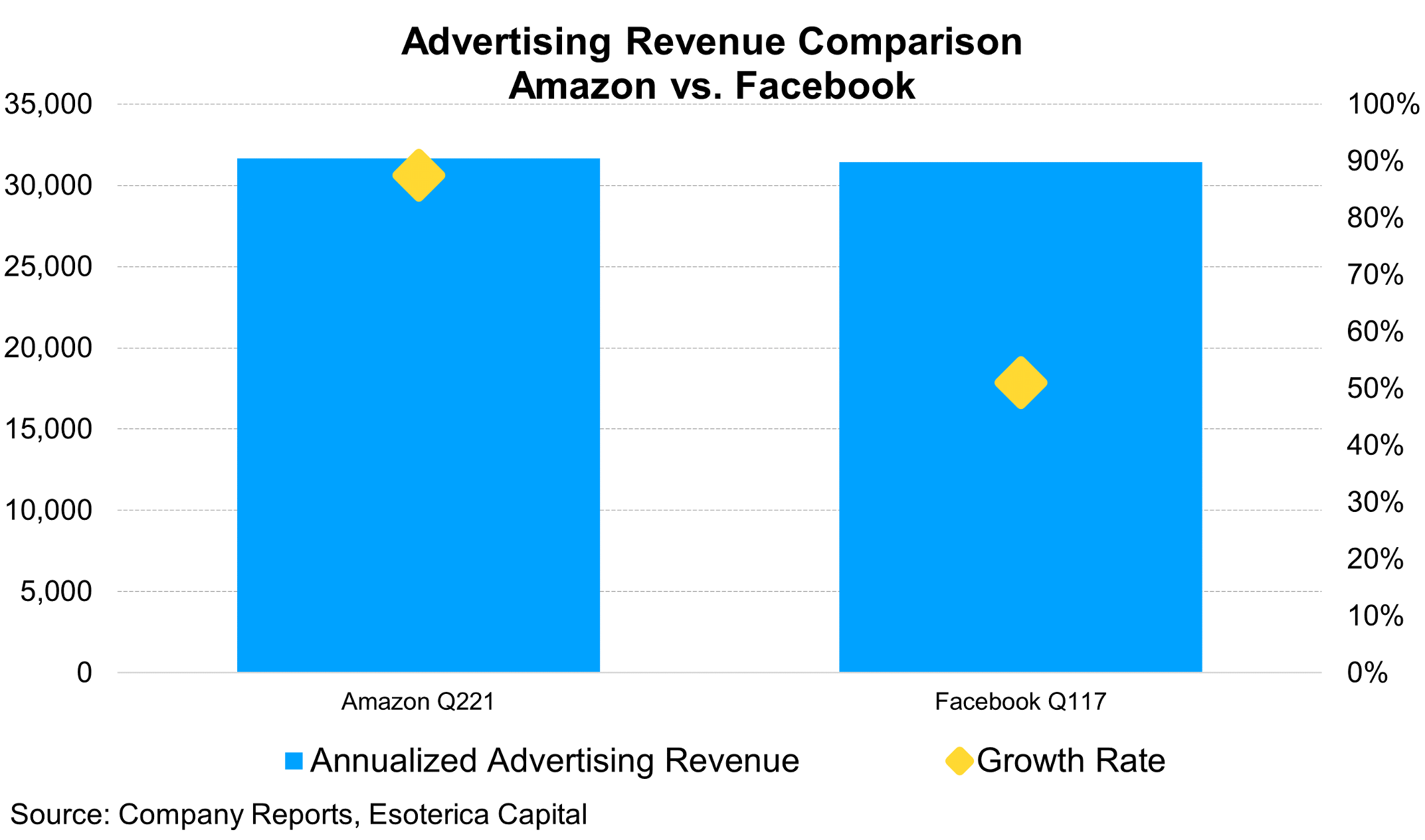

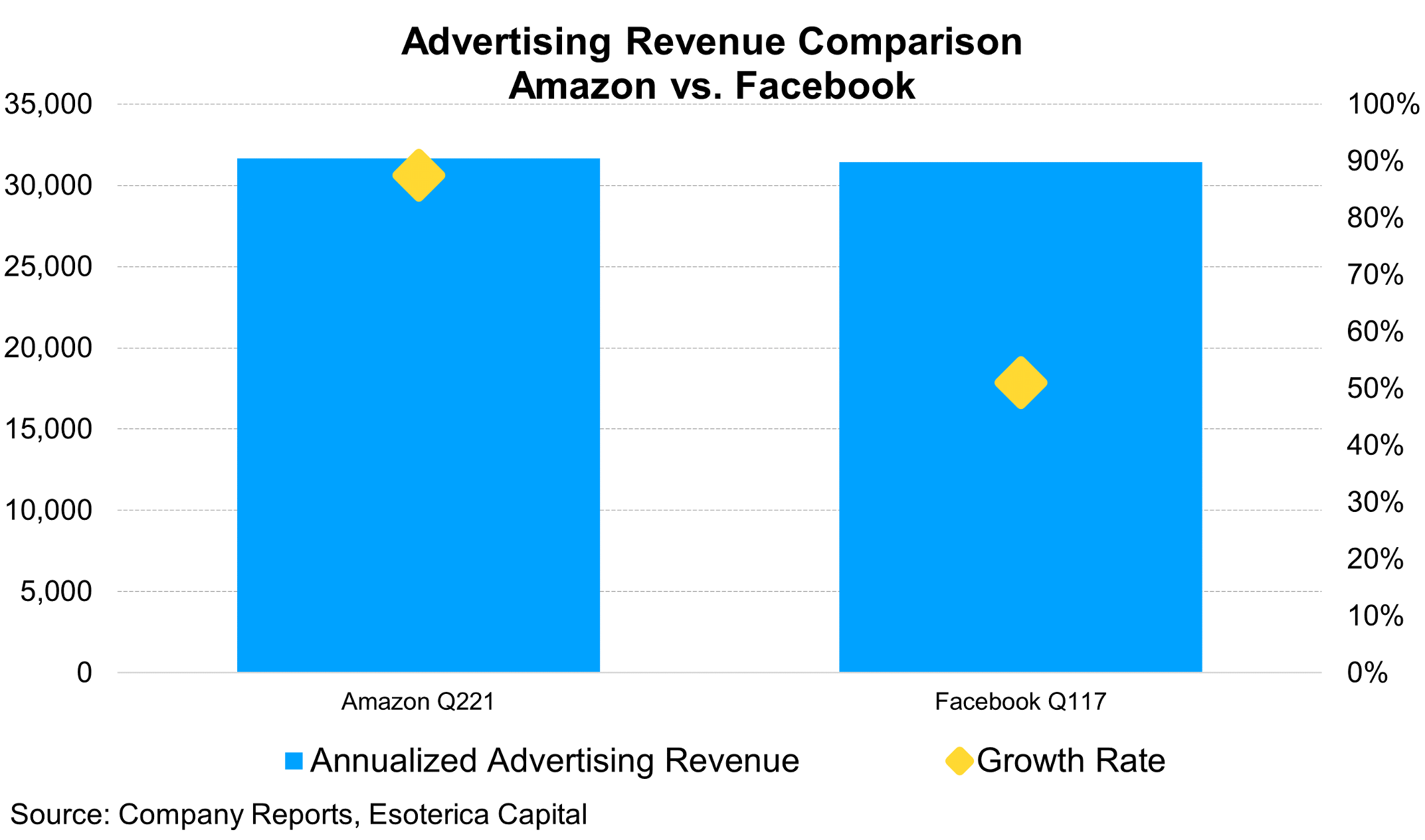

The advertising business also accelerated to 87% growth from ~40% pre-COVID and ran at a $30 billion annualized run rate. Facebook was growing at less than 50% and decelerating at a similar scale to put things into perspective. Together with third-party services and retail subscriptions, the higher-margin portion of Amazon contributed 49% of total revenue compared to less than 40% pre-COVID.

Close

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.