No Sign of Margin Contraction Yet

Investors have voiced concerns over negative earnings revisions of U.S. companies in the coming quarters, thanks to all the world's troubles. For example, Mike Wilson at Morgan Stanley recently commented, "U.S. corporates now face decelerating sales growth coupled with higher costs, pointing to a steep deceleration in earnings growth over the coming months." Some other strategists/economists also followed suit. Here are the key arguments,

Soft-landing or even recession under the Fed's aggressive hiking plan;

Volatile and elevated commodity prices caused by the Russian/Ukraine conflict worsened inflation;

Further supply chain disruption due to the lockdowns in China.

While the EPS YoY growth will undoubtedly slow down from 2021 due to the tough comp, we haven't seen a broad-based margin contraction yet. In their latest earnings report, many consumer discretionary companies (brands and retailers), most sensitive to economic cycles, projected stable margins amid the inflation pressure in 2022. There are at least three positive contributing factors:

Stable freight price: large U.S. brands had signed long-term contracts (>1 year) with ocean carriers at a price well below the peak in Q3'21. The port congestion in California is also easing, and we are unlikely to see the large brands dealing with sky-high transportation costs or a severe shortage of containers again.

Cost-savings from COVID: Amazon paid over $15 billion COVID expense since the pandemic. Walmart spent $450 million in FQ4'21 alone. We are likely to see companies working down their COVID expenses throughout 2022, which will lift margins.

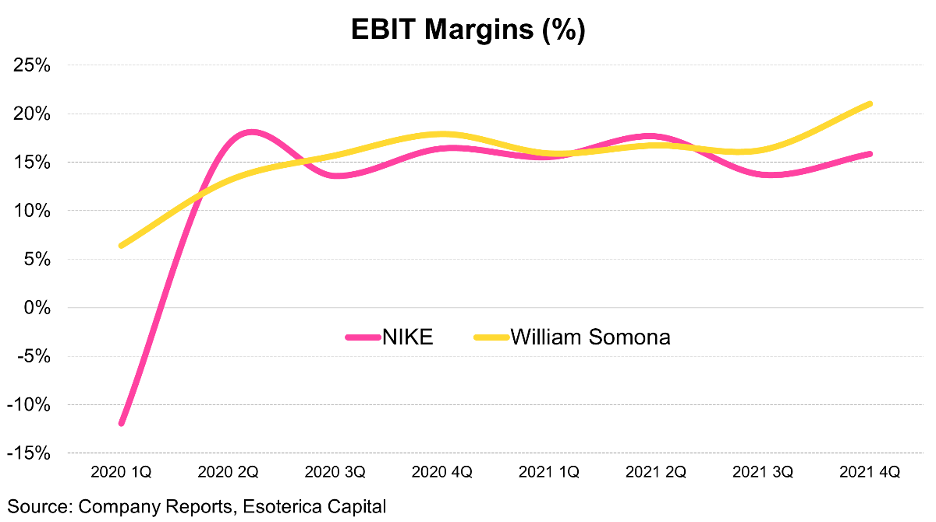

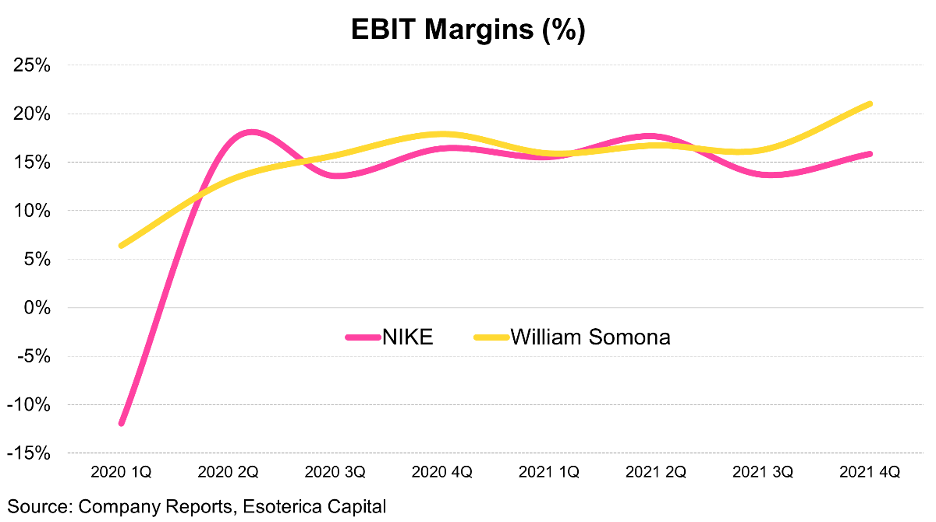

Digital transformation: companies haven't slowed down their digital transformation despite the macro headwinds. We see an accelerated transition to "Direct-to-consumer" and "eCommerce," both are higher margin accretive. For example, Nike printed a 15.8% EBIT margin in its earnings this week, well ahead of the consensus of 13.4%. The key contributor is the growth of NIKE Direct, carrying higher margins than the rest of the group.

"This year, we're incredibly proud by at least 150 basis points of gross margin expansion, where we've absorbed more than 100 basis points of unplanned costs associated with supply chain, logistics and wages to move product" -- Matt Friend, NIKE CFO "So far, in the first quarter, we continue to see strong sales and margins. And as we look further, we are confident in our long-term outlook, driving at least mid-to high single-digit comps with top-line growth to $10 billion by 2024 and operating margins relatively in line with fiscal 2021." -- Laura Alber, William Sonoma CFO

Close

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.