Commodities in Your Portfolio

What do commodities have to do with your basic investment strategy? Commodities are an individual asset class and can serve as portfolio diversifiers.

In addition, monitoring commodity markets can provide insights into the global growth picture. I tend to focus on three main commodities: copper, gold, and oil.

Copper is a very important industrial metal. Copper pipes line the walls of commercial and residential structures. Copper is also used in tech products, like smartphones. It has been said that copper has a Ph.D. in economics because as copper goes, so does global growth.

Gold is a completely different animal than copper, as it doesn’t play much of a role as an industrial metal. I often say gold has multiple personality disorder. Gold tends to plays three roles, depending on temperament:

as a safe haven investment/risk-off hedge,

as a U.S. dollar substitute (i.e., the anti-US$), and

as a real asset / inflation hedge.

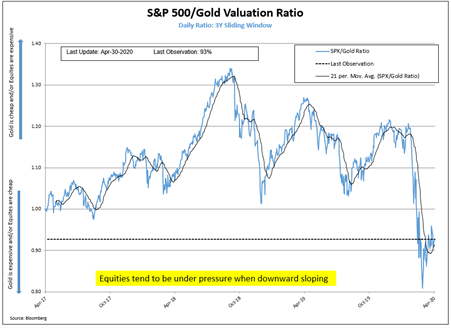

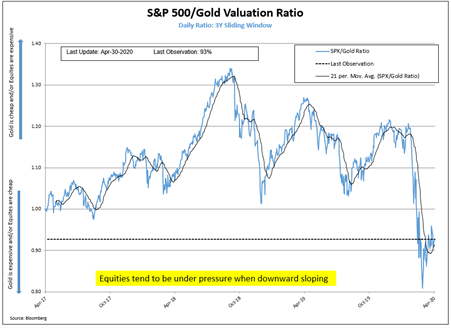

The chart below shows I use gold as a risk appetite measure.

Close

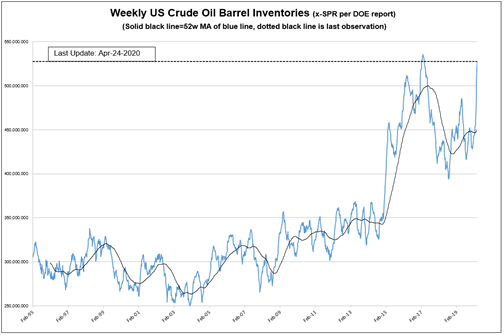

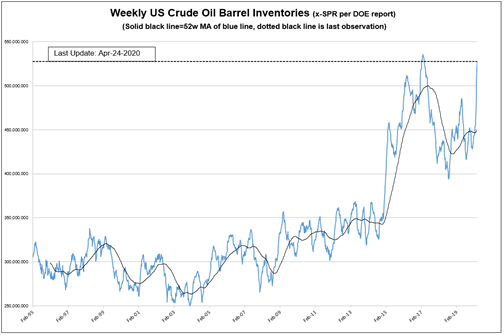

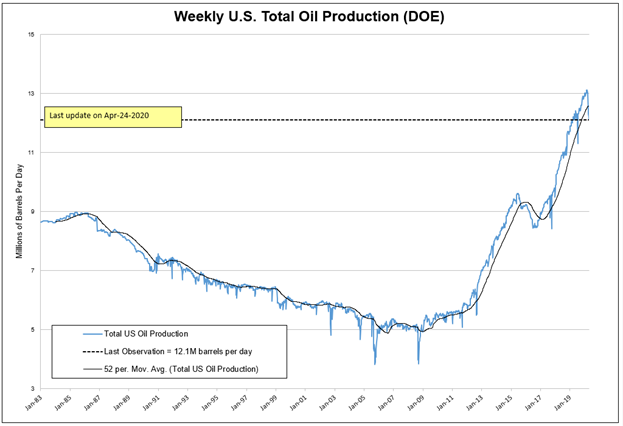

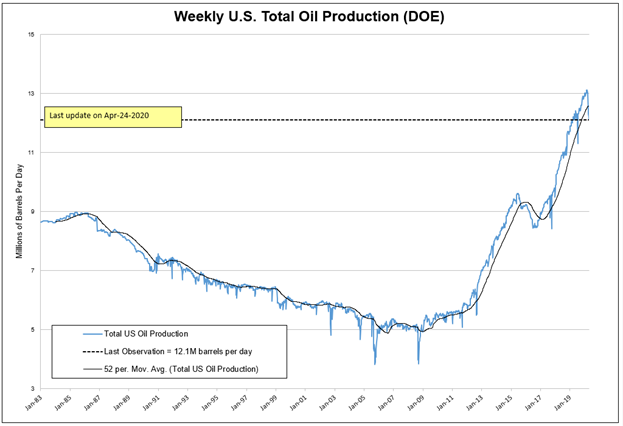

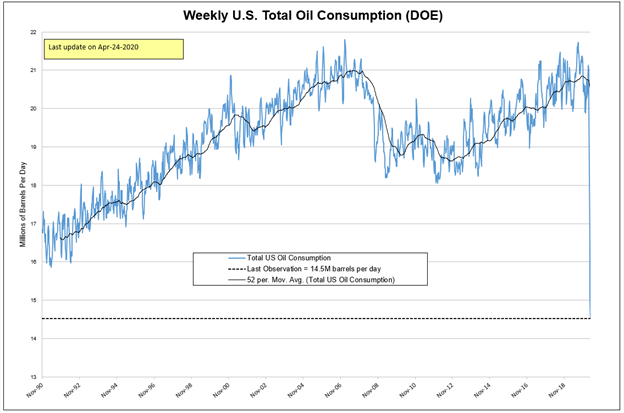

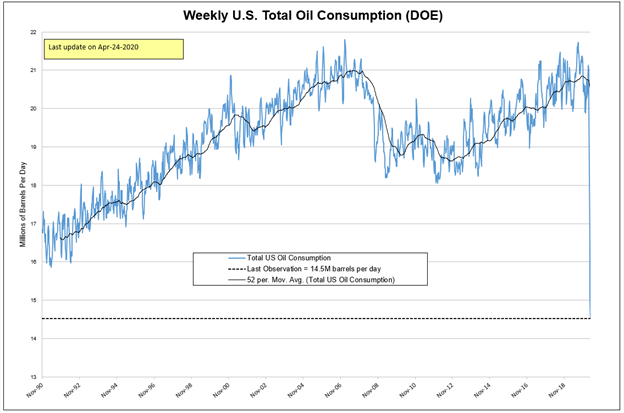

Oil and gasoline are terribly important, for obvious reasons, to global growth. I am far from being an expert on commodities so I try to keep things simple. I focus on demand and supply metrics. The below charts illustrate how I track consumption, production, and inventories.

Close

Close

Close

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.