How to Construct a Portfolio

The recommended portfolio construction process is always based on diversification.

Yet, there is disagreement, in the profession, as to how best to attain that diversification. The traditional approach is to treat individual asset classes, such as stocks and bonds, as the portfolio building blocks. A newer approach contends that better diversification is achieved using so-called risk factors, the underlying drivers of risk and return for an individual asset class.

This is not as confusing as it might initially appear. Consider equities. The primary driver of the equity risk premium is the economic growth risk factor, the so-called “market beta.” In addition to “market beta,” investors often like to target other risk factors, through allocation tilts, to capture other types of risk premia and attain better diversification. Some of the more popular equity tilts include:

Small-cap stocks (e.g., S&P 600)

Mid-cap stocks (e.g., S&P 400)

Large-cap stocks (e.g., S&P 500)

Foreign developed market stocks (e.g., MSCI EAFE)

Emerging market stocks (e.g., MSCI EM)

Value stocks (e.g., S&P 500 Value)

Growth stocks (e.g., S&P 500 Growth)

Low volatility stocks (e.g., S&P 500 Low Volatility)

High quality stocks (e.g., MSCI U.S. Quality)

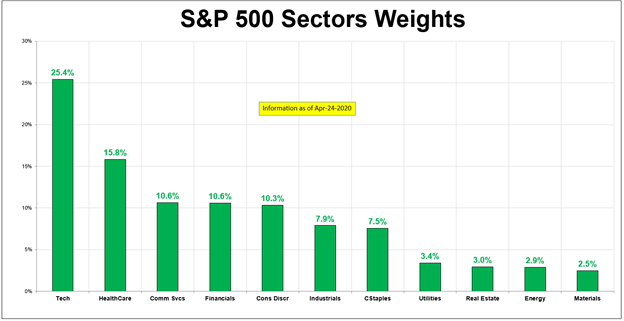

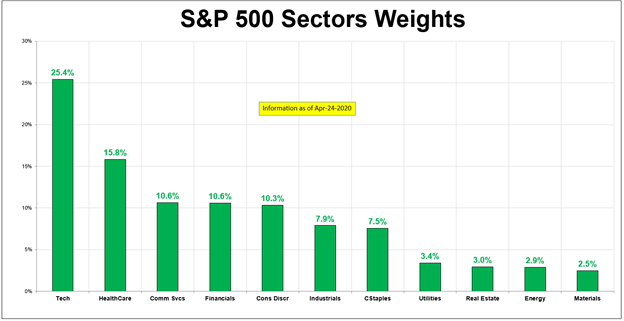

An investor can attain diversification by allocating across the above investible risk factors. In addition, we should remember that diversification exists within the above areas. For example, the chart below shows that a position in the S&P 500 provides market beta exposure as well as diversified exposure to the sector/industry risk factor.

Close

The above chart highlights the current 11 primary sectors in the U.S. These sector weights vary over time. For instance, the “Technology” sector weight has been gradually increasing over the last few years in line with the global growth of digital economies. Individual sector exposure is attainable, just like the investible risk factors bulleted before, as there is also liquid and cost-efficient sector ETFs.

Diversification is a good and prudent thing to focus on, regardless of whether it is attained from an asset class or a risk factor perspective. Portfolios constructed with a mix of stocks, bonds, commodities, etc., will be diversified. Better diversification is attainable if you allocate across the risk factors underlying each of these asset classes. Diversification can lower the risk of your portfolio AND allow you exposure to multiple risk premia (i.e., multiple ways to make money!).

More sophisticated investors like to adjust their allocation tilts over time, based on the shifting market conditions. ”Up market cycles” tend to result in out-performance of small caps, discretionary, emerging and growth stocks. More defensive tilts tend to outperform during “down” markets. Defensive tilts include: utilities, staples, low volatility, high quality, value and large caps. The idea is to tilt your portfolio in the direction of what you expect will be the most highly compensated risk factors going forward.

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.