Monthly Investor Letter, April 2022

The State of the (New) Economy

Instead of throwing hard-to-digest economic data to you, we would like to share what we’ve learned from the companies we cover. There are many worries going into the earnings season about the softer macro environment and potential weakness in Europe. But results from software companies, especially everything cloud-related, have been very robust. Public cloud spending did not see any slowing down. AWS grew 37% on the more challenging year-over-year comparison, Google Cloud grew 44%, and Azure growth accelerated by 300bps this quarter to 49% as the number of $100M+ deals more than doubled compared to last year. The most notable comment we heard during the earning season goes to Microsoft on the sustainability of software growth during macro uncertainty and inflation.

“I don't hear of businesses looking to their IT budgets or digital transformation projects as the place for cuts. If anything, some of these projects are the way they are going to accelerate their transformation. I have not seen this level of demand for automation technology to improve productivity because in an inflationary environment, the only deflationary force is software.”

-- Satya Nadella, Microsoft CEO

Semiconductor and hardware results, for the most part, are better than expected. There were worries that the weakness in the PC and smartphone market signals a broader downturn for the semiconductor market. But based on the results we've seen so far, the weakness seems to be limited to the low end of the PC and smartphone market, with the continued strength in other markets more than making up for it. The server market is again a bright spot. Our long-time favorite, AMD, continued to show its "boring execution," with server revenue doubling year-over-year again for both cloud and traditional enterprise customers.

“Based on higher AMD organic growth, as well as the addition of Xilinx with strong demand across multiple end markets, we now expect annual revenue to grow by approximately 60% year-over-year, up from approximately 31% growth we guided at the beginning of the year.”

-- Lisa Su, AMD CEO

The largest beneficiary over the past two years, e-commerce, is seeing the most challenges now. Growth slowed down across the board, and management cited several reasons, including 1) tough COVID period comparison, 2) reopening headwind as consumers shift spending from physical goods to services, and 3) the emerging pressure of higher cost and lower real consumer disposable income due to higher inflation. The first two points are well understood and are a natural normalization process as we enter the third year of COVID. The biggest unknown factor is how long inflation will stay elevated and how badly it will negatively impact consumer spending.

“There are no indicators that we're seeing of weakness in consumer demand. But we're wary of it as probably all companies are because household budgets are tightened when fuel costs are doubling and a big part of the year ripples through food, it ripples through everything else.”

-- Brian Olsavsky, Amazon CFO

Fed Has a Neutral Rate Problem

“Finally, we will need to continue to assess where neutral is. If the economy is in fact in a higher-pressure equilibrium, that might indicate the neutral long-term real rate has increased, which would then require even higher rates to reach a contractionary stance that would bring the economy into balance.”

-- Neel Kashkari, President of the Federal Reserve Bank of Minneapolis,

Policy Has Tightened a Lot. Is It Enough? May 6, 2020.

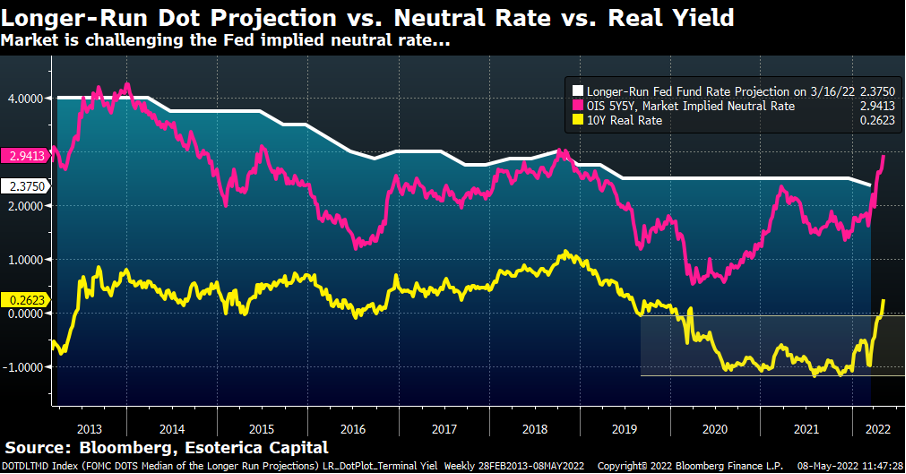

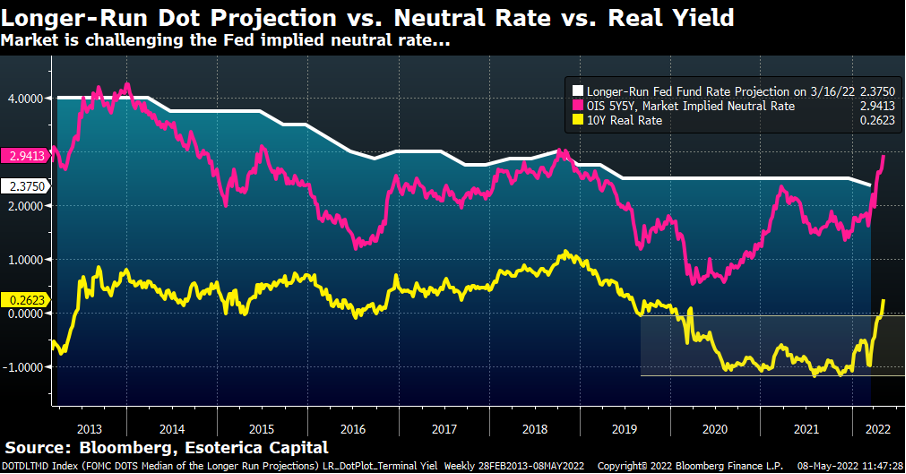

In the March FOMC meeting, we were worried that the Fed might raise the longer-run fed funds rate projection to signal its firm resolve to control the soaring inflation (Fed-implied neutral rate, Chart 1). Surprisingly, the Fed lowered the neutral rate dot to 2.38% from 2.50%, temporarily calming down the nervous financial markets and spurring a solid rally in late March.

Close

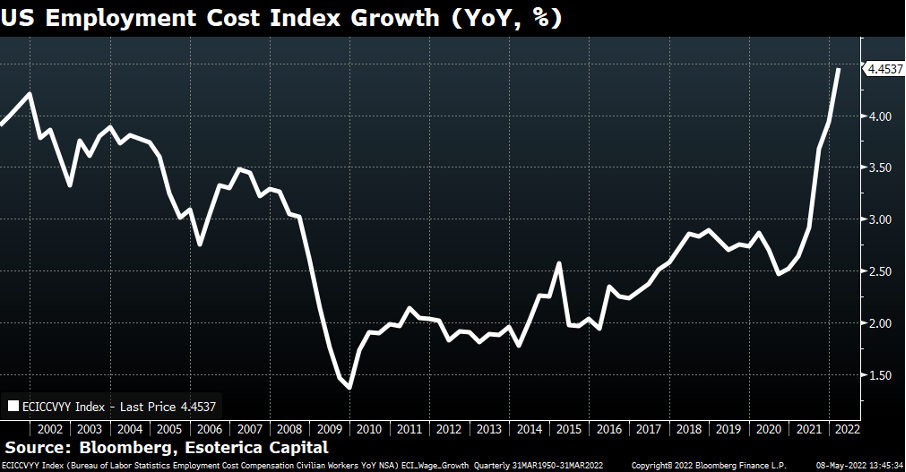

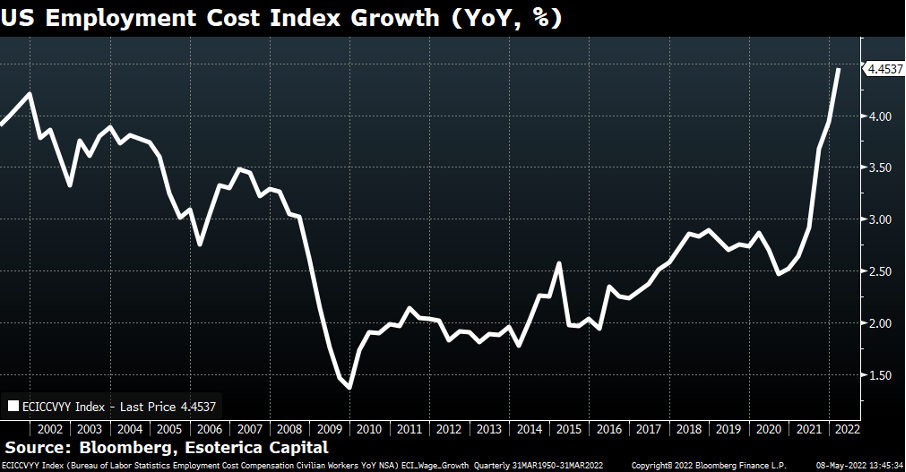

Since the Fed started to offer the dot plot, the upper side of the market-implied neutral rate has been anchored to the Fed’s guidance and never seriously challenged it (Chart 1). However, this time seems different. Into April, the OIS 5Y5Y has been climbing way beyond the Fed’s neutral rate on the back of 1) increasingly hawkish rhetoric from the Fed officials, such as James Bullard’s 75bps hike and John William’s quest for positive real yield, 2) record-high inflation prints from both the U.S. and Europe, and 3) the unabating wage growth like the employment cost index accelerating again in the first quarter (Chart 2).

Close

There is no doubt that the Fed was not as hawkish as the market in the May FOMC meeting. It’s quite a pivot for Chair Jay Powell to give up some optionality by ruling out 75bps hikes. However, the current pain point for the markets resides in the uncertainty of the policy path in the coming quarters: does the Fed need rates to be restrictive? If so, by how much? Unfortunately, the Chair’s guess is as good as yours.

“It's a very difficult environment to try to give forward guidance, 60, 90 days in advance. There are so many things that can happen in the economy and around the world. So, you know, we're leaving ourselves room to look at the data and make a decision as we get there.”

-- Fed Chair Jerome Powell at FOMC press conference on May 4th, 2022.

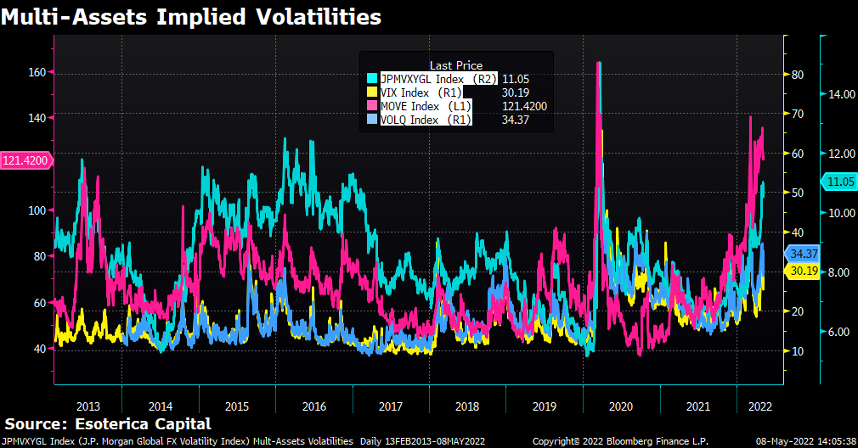

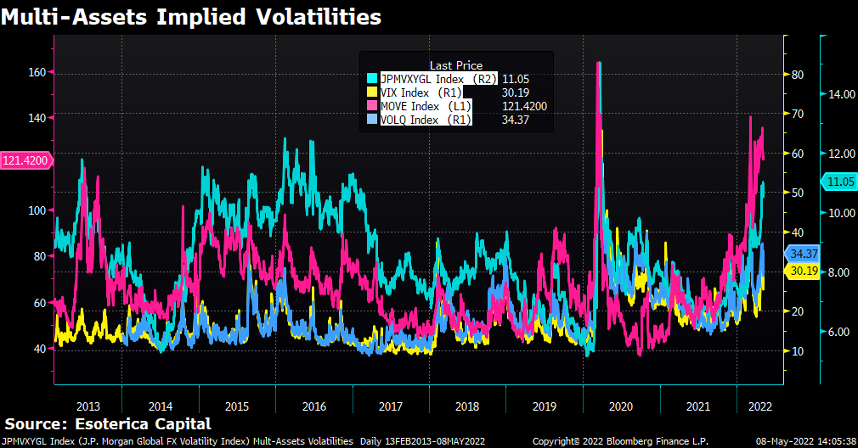

When the most dovish Fed policymaker, Neel Kashkari, starts doubting his not-so-distant neutral rate estimate, it adds fuel to the fire. The process for the markets to search for a new equilibrium (e.g., neutral rate) introduces more volatilities. Since rates are the fundamental anchor to the valuations of other risky assets (equities, credits, etc.), this volatility will inevitably spill over and be amplified (Chart 3). From this angle, the head-scratching market reactions post the FOMC meeting become easier to understand.

Close

Value Factor & Real Yield, Two Sides of the Same Coin

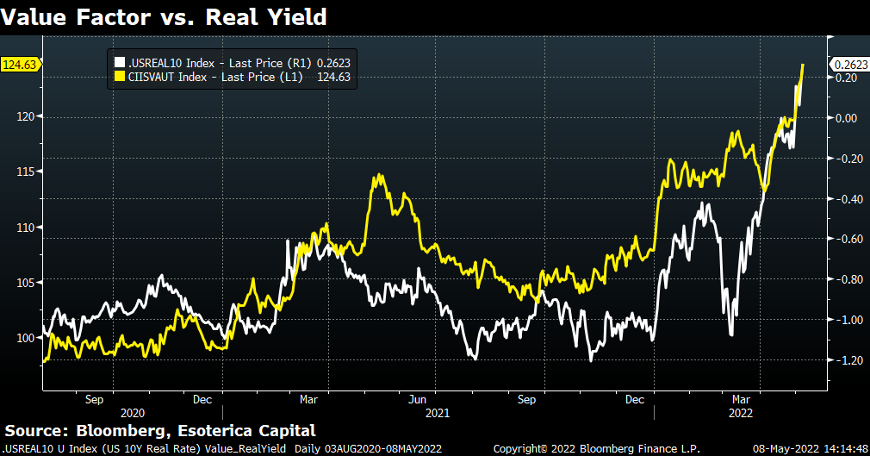

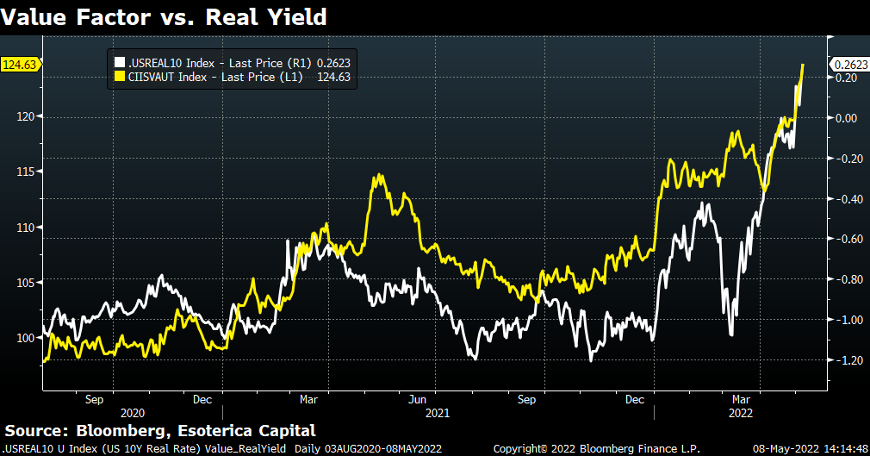

The real yield contributed the most to the increase of the nominal neutral rate, which is the financial condition tightening that the Fed hopes for. There is only one clear winner in the equity market in such an environment, the value factor (Chart 4). The high multiple stocks have been penalized again and again in this process. The decisive rollover of the value factor could be the sign that the real yield has reached the cycle high. Stay tuned.

Close

Equities Not Out of the Woods Yet

The Fed has officially announced the QT. The rates market is searching for an appropriate neutral rate. Everybody is wondering how restrictive the policy rate should go to contain the inflation. A soft landing or a hard landing it’s a matter of luck. Let’s be very honest: the Fed has blunt weapons, not surgical tools. What’s the implication for equity investors, then? How do we put this all together?

Here is a simple framework we propose to analyze the equity risk premium. It has been long debated what has been driving the equity returns in the era of QEs (post GFC). Many believe it’s the size of the Fed’s balance sheet, the reserves, to be more precise (the Quantity factor). Others believe the low and stable real yield (cost of capital) contributed the most (the Price factor). We believe both factors matter, as illustrated below (Chart 5). Equity’s performance was the worst when both factors were headwinds. Citi’s Matt King has done comprehensive research on this topic. We refer our interested readers to his work.

From this point onward, the size of the Fed’s reserve is more likely to shrink, thanks to 1) QT, 2) the reverse repo facility (RRP) usage staying elevated in the near term, 3) the Treasury keeping a larger cash balance at the Fed. The shrinking reserve is negative to the equity risk premium. The Quantity factor is a headwind; then, it’s up to the Price factor to save the day. Equity investors will have to wait until the real yield settles to become bullish again. Inflation is still the missing piece of the puzzle. We ought to be patient.

Close

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.