Where Do Equities Go From Here?

Equities are currently over-bought based on most short-term momentum oscillators. As evidence, the chart below shows the number of constituents trading above their 50-day moving average. We have just experienced record highs (or near all-time highs) for all developed markets around the world.

Close

In addition to being over-bought on a short-term perspective, valuations are becoming a huge concern.

Our second chart shows the U.S. market is currently the most over-valued since the dot-com era (based on forward P/E ratios for the S&P 500).

Close

Is this a bubble?

If markets are over-priced and over-bought, you have to be concerned about being in a bubble. Yet, most positioning indicators suggest hedge funds and long-only institutional equity managers have not fully participated in the equity rally.

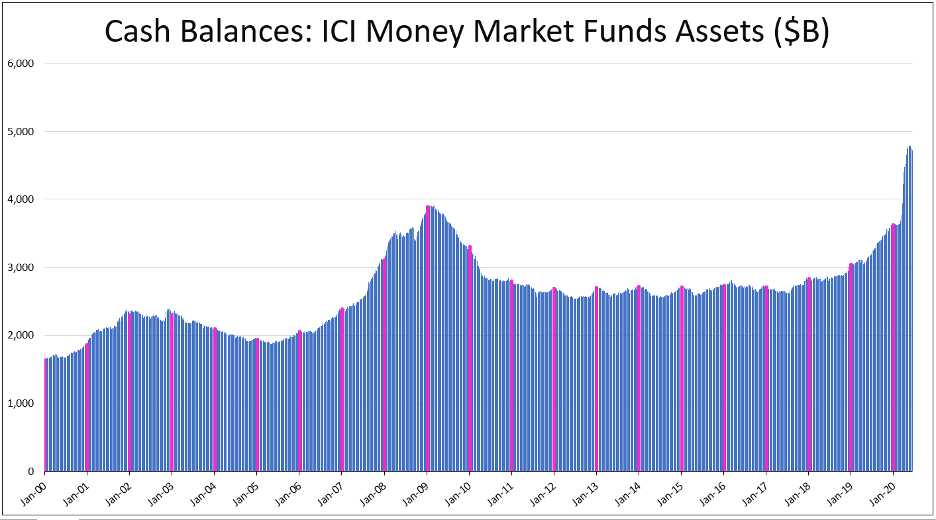

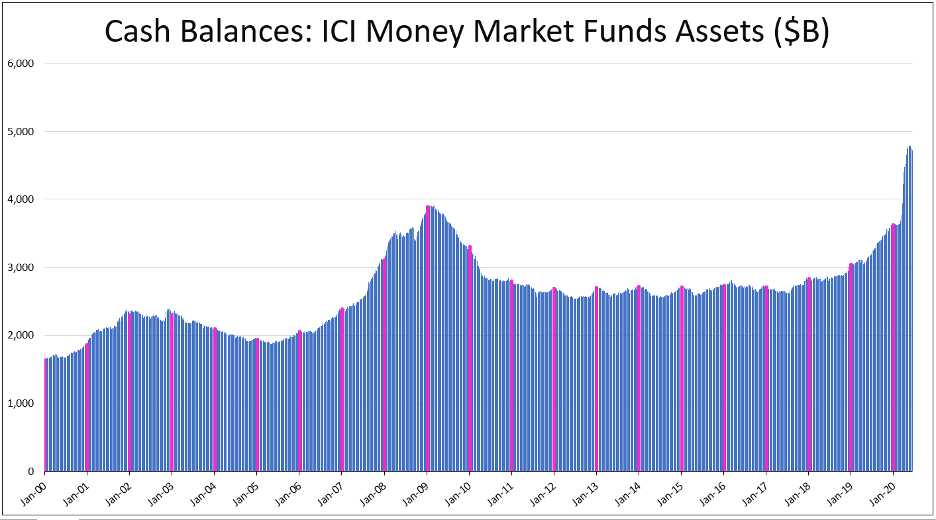

Our final chart shows investors are sitting on the biggest pile of cash ever.

Close

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.